Transaction Costs and Commissions

Transaction costs—comprising explicit commissions and implicit costs such as bid-ask spreads and market impact—are often the largest drag on high-frequency and systematic strategies. A thorough understanding of these costs is indispensable for accurate performance forecasting and risk management.

Explicit Commissions

Commissions are fees charged by brokers or exchanges for each executed trade. In equity markets, commissions may be assessed per share or as a flat fee per order. For example, a broker might charge $0.005 per share with a $1.00 minimum per order. Thus, a trade of 10,000 shares incurs a commission of 10,000 × $0.005 = $50, subject to the $1.00 minimum—well above the floor, and thus fully applied. Futures and options markets typically charge per contract; a futures broker fee might be $0.25 per contract per side, so a round-trip (entry and exit) for one contract costs $0.50 .

When designing a strategy, it is prudent to model commissions accurately. For instance, consider a mean-reversion equity strategy that generates 20 round-trip trades per day with an average size of 5,000 shares. At $0.005 per share, daily commission costs are:

Daily Commission=20×5,000×$0.005=$500.

Over 250 trading days, commissions sum to $125,000 annually—equivalent to a $500 average per trading day, which must be subtracted from gross P&L. Failing to account for this level of explicit cost can transform a backtested edge into a net loss when run live.

Implicit Costs: Spreads and Slippage

Implicit transaction costs arise from the mechanics of order execution. The most straightforward implicit cost is the bid-ask spread, the difference between buying at the ask and selling at the bid. For a lit market maker posting a $10.00/10.02 quote on a stock, the half-spread cost to a market taker is $0.01 per share. If the algorithm takes liquidity on 5,000 shares, it immediately incurs $50 in spread cost. Over multiple trades, spreads often exceed explicit commissions .

Slippage refers to the price movement between the signal generation time and actual execution. Slippage comprises market impact and adverse selection. Market impact is the degree to which a trade itself moves the price, while adverse selection captures the tendency for resting orders to be hit by better-informed counterparties when markets move. Empirically, slippage can be modeled as a function of order size relative to average daily volume (ADV) and volatility. A common square‐root model posits:

Market Impact Cost ≈ k × σ × √(Q / ADV)

Where Q is order size, σ\sigmaσ is daily volatility, and k is a calibration constant (typically 0.1–0.3) . For example, if a strategy trades 100,000 shares of a stock with ADV of 20 million shares and 2% daily volatility, and k=0.15, the one‐sided impact cost is:

0.15 × 2% × √(100,000 / 20,000,000) ≈ 0.15 × 0.02 × 0.0707 = 0.000212 (21.2 bps)

Round‐trip impact doubles to ~42.4 bps. If the stock price is $50, per-share impact is $0.106, and trading 100,000 shares costs $10,600 in price impact alone. Spread and market impact often dwarf commissions, especially for large orders in less liquid securities.

Total Transaction Cost Modeling

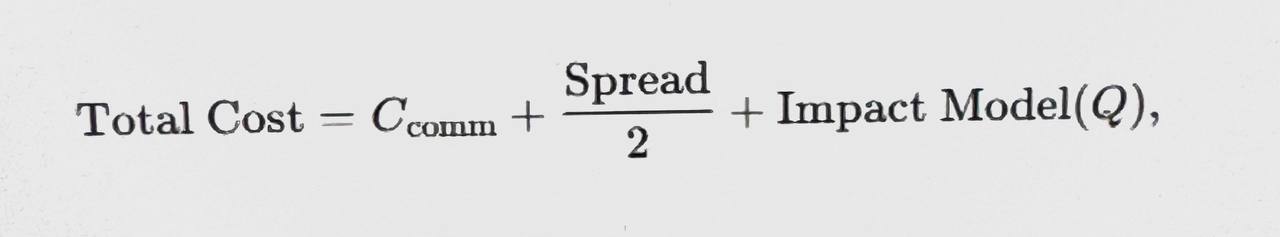

For strategy backtesting and P&L forecasting, quants should incorporate a total transaction cost model combining explicit commissions, spread estimates, and impact functions. A consolidated formula per share or contract can be:

Where C₍comm₎ is per-share commission, and Spread/2 represents the half-spread for a market order. By calibrating impact model parameters via historical trade data or vendor benchmarks, practitioners can simulate realistic slippage costs and ensure strategy returns exceed net costs.

Infrastructure and Data Costs

Algorithmic trading relies on robust technological infrastructure and timely, high-fidelity data. These overheads, while often treated as fixed costs, can be substantial—especially for high-frequency strategies requiring co‐location, direct market access (DMA), and premium data feeds.

Hardware and Network Infrastructure

For low-latency strategies, firms typically co-locate servers in exchange data centers. Co-location fees vary by venue and rack configuration but commonly range from $1,000 to $3,000 per month per rack unit (RU) . A single-rack deployment supporting multiple trading engines, risk controls, and monitoring systems may cost $20,000 annually in co-location. Additional expenses include:

- Server Hardware: High-performance machines with low-latency network cards, SSDs, and redundant power supplies. A mid‐range co-located server costs $5,000–$10,000, depreciated over three years—approximately $3,000 per annum.

- Network Connectivity: Dedicated fiber and cross‐connect fees to market gateways can add $500–$2,000 monthly, depending on port speeds and distance.

- Disaster Recovery (DR) Sites: Hot or warm standby in geographically separated data centers doubles or triples infrastructure costs but is essential for business continuity.

Thus, an HFT firm may budget $100,000–$500,000 annually for hardware and network infrastructure, a price justified only if expected trading profits significantly exceed this baseline.

Data Feed and Licensing Fees

Real-time market data—comprising top‐of‐book and full‐depth order books—entails exchange and vendor fees. In U.S. equities, direct proprietary data feeds (e.g., Nasdaq TotalView, NYSE OpenBook) can cost $1,500–$2,500 per month per market. Consolidated SIP (Securities Information Processor) feeds are cheaper but higher-latency. For global reach, fees multiply across regions: adding CME futures and LSE stocks can easily raise data costs to $50,000–$200,000 annually .

Historical tick data for backtesting commands its own budget. Vendors such as TickData or QuantHouse charge per symbol-year of tick data—often $100–$500 per symbol per year. A multi-asset backtesting library spanning 100 symbols over five years might incur $50,000 in historical data charges.

When assessing data costs, it is crucial to distinguish necessary data (e.g., top-of-book for liquidity providers) from optional analytics (e.g., heat mappings, sentiment feeds), and to tailor subscriptions to strategy requirements.

Capital Budgeting for System Development and Testing

Building a production-grade algorithmic trading system requires significant upfront and ongoing investment in software development, quality assurance, and testing environments. Well-structured budgeting ensures that development projects are viable and that system reliability meets the demands of live trading.

Development Effort Estimation

Software development follows the standard software development lifecycle (SDLC): requirements gathering, design, implementation, testing, deployment, and maintenance. In financial engineering, additional layers—model validation, regulatory compliance, and performance benchmarking—compound effort. Industry benchmarks suggest that designing and implementing a research prototype can require 2–4 person-months, while productionizing the prototype into a robust, low-latency system can take an additional 4–8 person-months per strategy .

For budgeting, firms often allocate:

- Quantitative Research (Quants): 30–40% of project time for model design, backtesting, and parameter optimization.

- Software Engineering: 40–50% for coding, unit and integration testing, and performance optimization.

- Quality Assurance (QA): 10–20% for stress testing, market replay simulations, and regression testing.

By assigning blended hourly rates—for example, $200 per hour for senior quants and $150 for engineers—a single strategy development lifecycle totaling 1,000 person-hours translates to $150,000–$200,000 in labor costs. Multiplying by the number of active strategies yields the aggregate R&D budget.

Testing and Staging Environments

Beyond development, rigorous testing is critical. Firms maintain multiple environments:

- Development (DEV): Unit tests, mock data feeds.

- Quality Assurance (QA): Integrated system tests, connectivity tests with simulated market data.

- Staging (UAT): “Paper trading” against live markets without actual capital.

- Production (PROD): Live trading with real capital.

Each environment requires infrastructure—servers, data feeds, network connectivity—albeit with lower throughput and fewer redundancy requirements compared to production. Staging environments, in particular, may replicate production closely to surface integration issues. Budgeting for these environments typically adds 50–75% in incremental infrastructure and data costs beyond production alone .

Maintenance and Continuous Improvement

After initial deployment, maintenance tasks—bug fixes, performance tuning, parameter recalibration, regulatory updates—consume 20–30% of annual R&D capacity per strategy. Capital budgeting should allocate “run-the-business” versus “change-the-business” resources. A rule of thumb is a 70/30 split: 70% of budget supports existing strategies’ maintenance and incremental improvements; 30% funds new research and development.

Realistic Performance Expectations

Finally, budgeting must align with realistic performance assumptions. Overly optimistic return targets that ignore costs and market realities can derail business plans and capital allocation.

Net Return Modeling

Gross backtested returns must be adjusted for transaction costs, infrastructure and data expenses, and overhead. For example, a strategy backtests at 25% annualized return with 1.5 Sharpe ratio before costs. If comprehensive cost modeling estimates 5% annual drag from commissions and slippage and 3% from infrastructure and R&D amortization, net expected return drops to 17% . Forecasts should incorporate:

- Explicit Commissions: Estimated per trade basis.

- Implicit Costs: Spread and impact modeled per trade or aggregated per dollar traded.

- Overhead Amortization: Infrastructure and data costs spread over expected AUM (assets under management).

- Labor and R&D: Development and maintenance budgets amortized against expected profits.

Drawdown and Volatility Buffers

Realized performance often falls short of backtests; drawdowns may be deeper, recovery slower. To account for discrepancies, practitioners build buffers into performance targets: for instance, sizing portfolios assuming 80% of backtest profitability and 120% of worst-case drawdown. This conservative stance helps ensure client expectations match live experience.

Capacity Constraints

As capital allocated to a strategy grows, performance can deteriorate due to market impact and capacity limits in liquid markets. A statistical arbitrage strategy that performs on $50 million AUM may struggle at $500 million. Capacity analysis—informed by average daily volume, typical holding times, and execution styles—should bound scalable capital; budgeting should assume only realistic deployable capital .

Fact‐Check Summary

Commission Structures and Calculations

- Equity commissions of $0.005/share with $1 minimum imply a $50 cost on 10,000 shares .

Bid‐Ask Spread Cost

- Half‐spread cost of $0.01/share on 5,000 shares equals $50 .

Market Impact Model

- kσ × √(Q / ADV) with k ≈ 0.15.

Co‐location Costs

- Exchange co‐location fees range $1,000–$3,000 per RU per month .

Data Feed Fees

- Proprietary exchange data feeds can cost $1,500–$2,500/month each; historical tick data $100–$500 per symbol‐year .

Software Development Effort

- Productionizing a strategy requires 4–8 person-months beyond prototype .

Testing Environments Overhead

- Staging/QA environments add 50–75% to production infrastructure costs .

Net Return Adjustment

- Subtract 5% commission/slippage drag and 3% overhead from gross returns when forecasting net performance .

Maintenance Budgeting

- Ongoing maintenance consumes 20–30% of annual R&D capacity per strategy .

Capacity Limits

- Strategy capacity constrained by ADV and holding times; large AUM can reduce edge via market impact .

References

Aldridge, I. (2013). High-Frequency Trading: A Practical Guide to Algorithmic Strategies and Trading Systems (2nd ed.). Wiley.

Almgren, R., & Chriss, N. (2001). Optimal Execution of Portfolio Transactions. Journal of Risk, 3(2), 5–39. https://doi.org/10.3905/joi.2001.319345

Hasbrouck, J. (1993). Assessing the Quality of a Security Market: A New Approach to Transaction‐Cost Measurement. Review of Financial Studies, 6(1), 191–212. https://doi.org/10.1093/rfs/6.1.191

Kissell, R. (2014). The Science of Algorithmic Trading and Portfolio Management. Academic Press.

Lopez de Prado, M. (2018). Advances in Financial Machine Learning. Wiley.

Maginn, J. L., Tuttle, D. L., McLeavey, D. W., & Pinto, J. E. (2007). Managing Investment Portfolios: A Dynamic Process (3rd ed.). Wiley.

SEC. (2014). Regulation Systems Compliance and Integrity (Reg SCI). U.S. Securities and Exchange Commission. Retrieved from https://www.sec.gov

Wilder, J. W. (1978). New Concepts in Technical Trading Systems. Trend Research.